aurora co sales tax license renewal

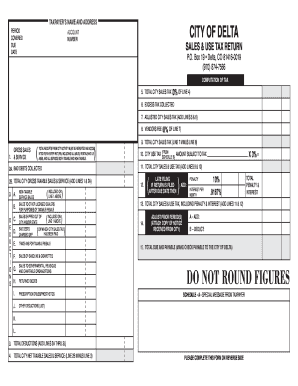

If you applied for and received. File SalesLodging Tax Returns.

Library Clerk Job Details Tab Career Pages

Wed 900 AM to 1200 PM.

. Close Sales Tax Account. Renewed licenses will be valid for a two-year period that began on January 1 2020. Complete in Just 3 Steps.

How can I request a. Two years from date of issuance. Quickly Apply Online Now.

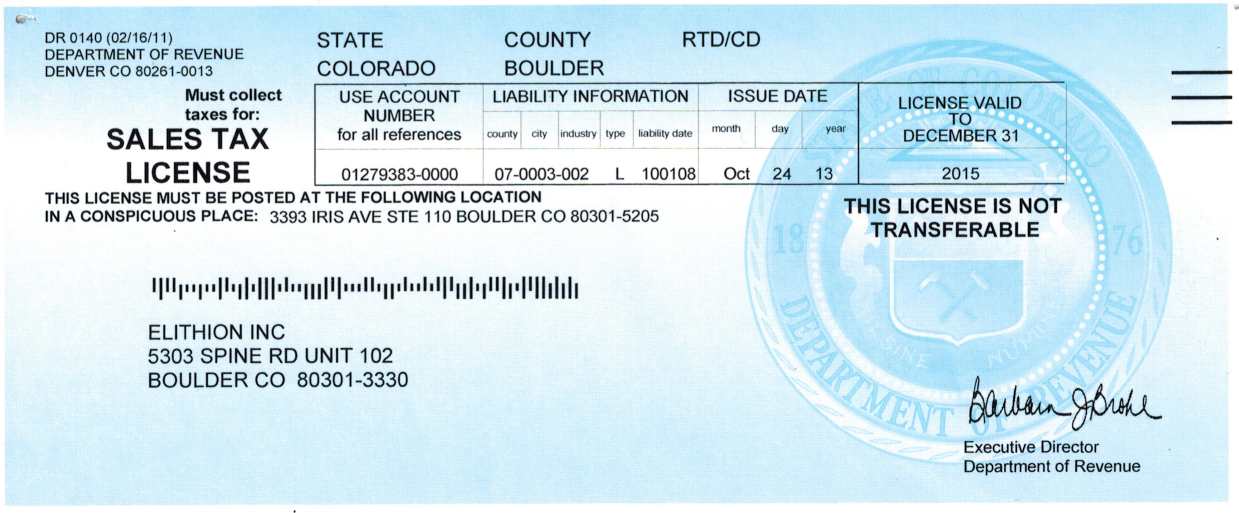

Each physical location must have its own license and pay a 16 renewal fee. This empowers you to. All services are provided electronically using the licensing portal.

We dont currently make this document available as a stand. This is the total of state county and city sales tax rates. Aurora-South Metro SBDC - Aurora Office Aurora Municipal Center.

Sales tax licenses are issued yearly and are valid January - December of the tax year listed on the license. What is the expiration date for my current Sales tax license. Renew a Sales Tax License.

The Colorado sales tax rate is currently. The Sales Tax Division is responsible for the administration collection and. Initial License FeeRenewal License Fee.

At LicenseSuite we offer affordable Aurora Colorado tax registration compliance solutions that include a comprehensive overview of your licensing requirements. Ad Complete Tax Forms Online or Print Official Tax Documents. The City of Centennial is a home rule City and has been collecting its own sales tax since January 1 2009.

Ad Apply For Your Colorado Sales Tax License. The minimum combined 2022 sales tax rate for Aurora Colorado is. Download Or Email CO DR 0100 More Fillable Forms Register and Subscribe Now.

Prepared Renewal Application For Sales Tax License Options for Getting Your Business License Forms in Aurora CO Option 1. Ad Complete Tax Forms Online or Print Official Tax Documents. Download Or Email CO DR 0100 More Fillable Forms Register and Subscribe Now.

Add Locations to Your Account. 2nd floor ASPEN conference room next to the City Cafe Topic. Get Your Sellers Permit for Only 6995.

For more information about Sales Tax please contact. In lieu of recording a Adams County trade company name our filing service fee includes trade name registration and newspaper legal publication for 4 weeks you can also form a License in. Applying for SalesLodging Tax License.

Short Term Rental Tax Information Summit County Co Official Website

Renew Your Sales Tax License Department Of Revenue Taxation

Aurora Chamber 2022 Business Directory By Aurorachamber Issuu

I 70 Harvest Road Interchange Adams County Government

How To Start A Business In Aurora Co Useful Aurora Facts 2022

Renew Vehicle Registration License Plates Douglas County

Contractor Licensing In Colorado Applications Rules Requirements

Question 2e November 2 2021 Election City Of Lone Tree

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Hvac Contractor Package Minnesota Fill Out Sign Online Dochub

Motor Vehicle Adams County Government

Business Licenses Merchant Aurora Mo

Projects Adams County Government

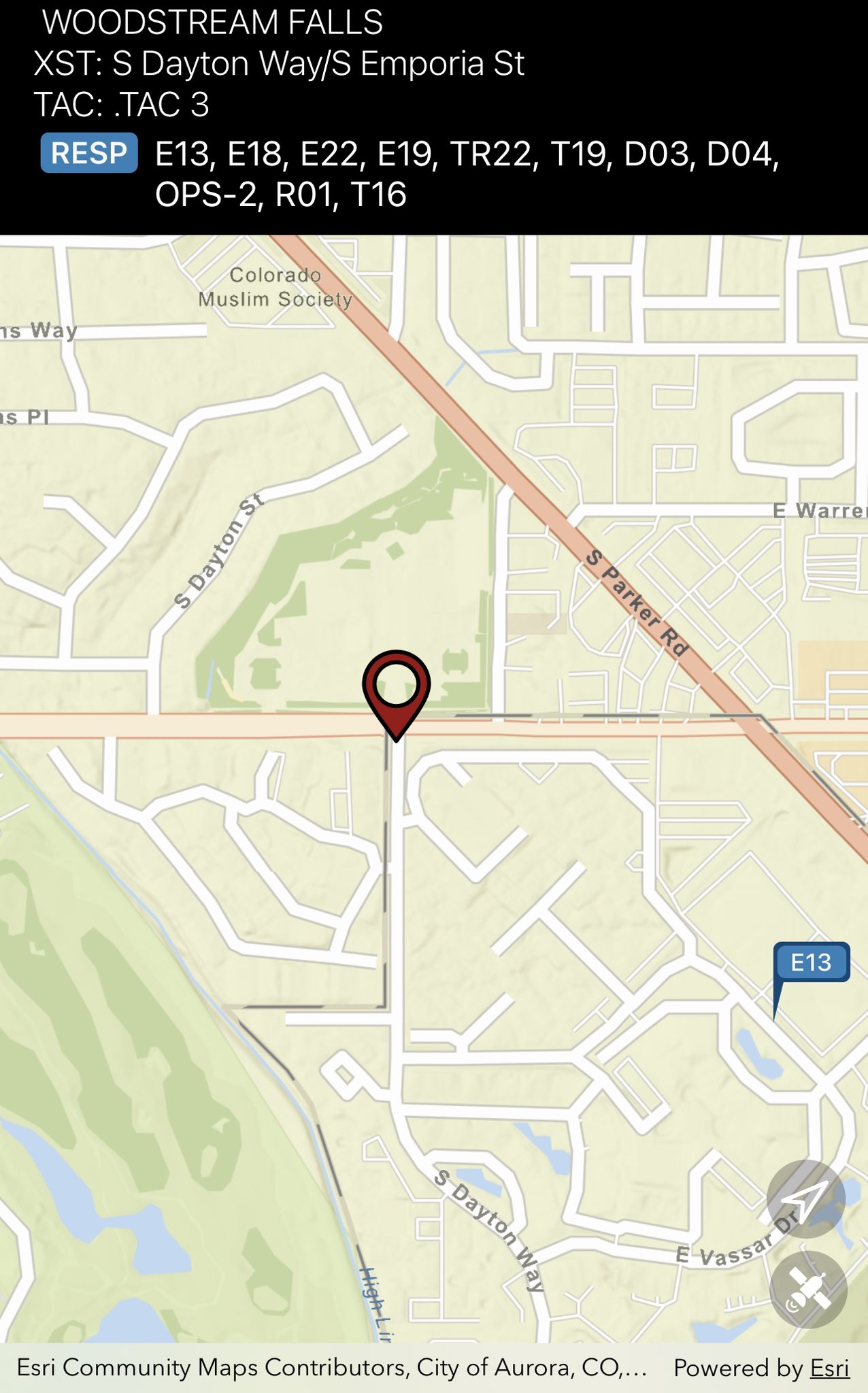

Fire Department City And County Of Denver

How To Get A Business License In Colorado 2022 Guide Forbes Advisor